What is Section 8 Company?

Any company formed with a prime objective of promoting specific fields and with a charitable aim is known as a Section 8 company. Moreover, Section 8 companies are governed under Section 8 of the Companies Act, 2013.

Since such companies are completely engaged in charitable work, they have several exemptions such as Income Tax exemption, etc. Furthermore, these companies don’t share the profits earned with any of its members. Rather, profit is used for promoting the company’s object.

In short, Section 8 Companies are Non-Profit Organizations or Non-Governmental Organizations formed with the intention of doing charity work and working towards social welfare.

If you know about NGO so, visit at NGO Registration in India

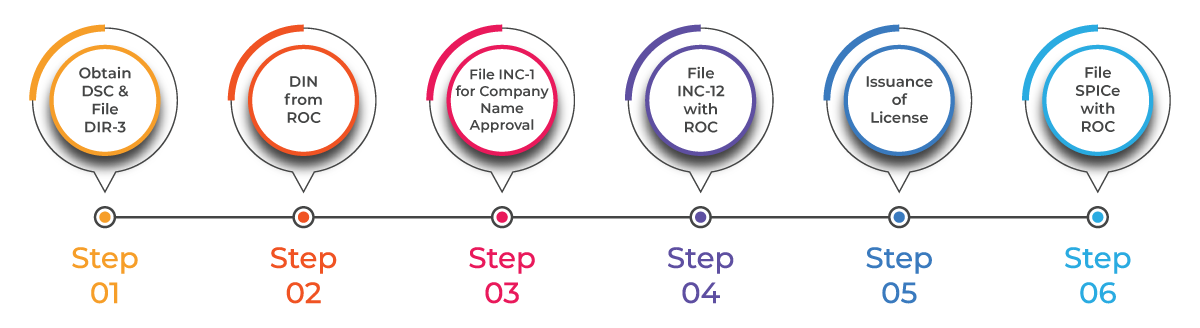

Section 8 Company Registration Procedure

Step 1: Obtain DSC and file Form DIR-3

The first step to incorporating Section 8 NGO in India is to obtain a DSC (Digital Signature Certificate) of the proposed directors of the company. After you have received the DSC, you need to file Form DIR-3 with the Registrar of Companies, requesting for a DIN (Director Identification Number).

For DIN, you need to attach documents such as Identity proof and Address proof.

Step 2: DIN From ROC

Step 3: File INC-1/RUN For Company Name Approval

Step 4: File Form INC-12 With The ROC

Once your company’s name is approved, you need to file Form INC-12 with the ROC. Form INC-12 is an application for the grant of license for operating the company as Section 8.

Documents you would require to attach with INC-12 are:

- As per Form INC-13, Memorandum of Association (MOA);

- Articles of Association (AOA);

- As per Form INC-14, Declaration from the Practicing Chartered Accountant;

- As per INC-15, Declaration from every person filing the application;

- Assessed expenditure and income for the next three years.

The subscription pages of the MOA and AOA of the company must contain the signature of every subscriber. Furthermore, it must also their name, address, and occupation. The subscribers must sign the document in the presence of a minimum of one witness who needs to attest the signature and add his name, address, and occupation, along with his signature.

Step 5: Issuance of License

Step 6: File SPICe Form INC-32 with the ROC

After you have received the license, you require filing SPICe INC-32 with the Registrar of Companies for company incorporation. Further, you are required to attach the following documents:

- As per INC-9, an affidavit from every director and subscriber;

- KYC of every director;

- Declaration regarding the deposits;

- Consent letter of every director;

- Form DIR-2 with an identity proof and address proof of the directors;

- Utility bills as an address proof of office which must not be older than two months;

- NOC in case the office premise is on rent or lease;

- Interest in other entities of all directors;

- Draft MOA and AOA.

If the ROC finds the form satisfying with every criterion, he will issue a COI (Certification of Incorporation) along with a unique CIN (Corporate Identity Number).